After a historic week, Indian market saw a blockbuster opening on Monday which took the Nifty50 to record high of 11,148.25 in morning trade. Tracking the momentum, the Nifty Bank and the S&P BSE Sensex rose to a fresh record high of 27,635.65 and 36,356.99 respectively.

Indian market closed the week on a high note, up 1.6 percent for the week ended January 25, ahead of the crucial Budget week which most experts think could belong to the bulls again.

The index is likely to clock fresh highs in the Budget week fuelled by further short coverings as well as strong global cues. Investors are advised to remain long on the index with a strict trailing stoploss around 11,000 which is a key support for the index.

However, in the budget week, analysts advise investors to remain stock specific and focus less on the index which is likely to remain volatile. One should look to buy the stocks from the sectors which have shown a lot of expectation buildup for the forthcoming budget.

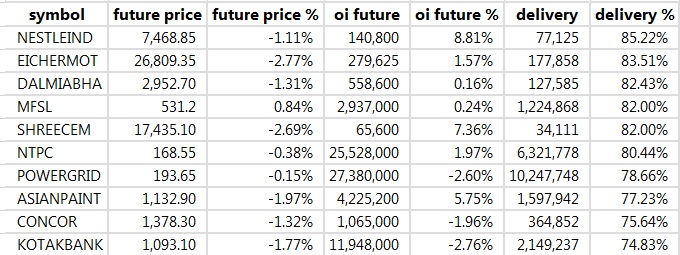

“Sectors which are bullish on their long-term charts and have witnessed outperformance viz., sectors like cement, infrastructure, FMCG, and automobiles are likely to exhibit bullishness ahead of budget as the near/short term charts are sustaining above breakout levels could be in action ahead of the Budget,” Rajesh Palviya, Head – Technical & Derivatives Analyst, Axis Securities told Moneycontrol.

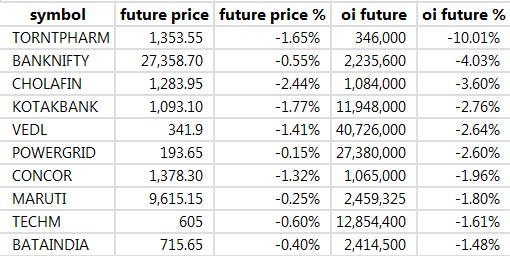

The market looks little nervous ahead of budget especially on long term capital gains (LTCG) front and fiscal consolidation roadmap which could fuel some profit taking either ahead of post Budget session.

“Most of the midcap stocks have witnessed profit booking and midcap index has corrected significantly ahead of budget. We feel the index is likely to hold the ground on the higher side till budget unfolds and Nifty is likely to scale up towards 11,200-11,300 in the pre-budget rally,” said Palviya.

The Nifty successfully managed to defend its important milestone of 11,000 on a weekly basis. Abundant liquidity and strong global cues supported the sentiment on the Street.

Of late, we saw tremendous optimism in our market and hence, the index kept marching higher to conquer many important junctions. “However, since the last couple of days, we can see some respite in the market as the index hastened towards its crucial near-term point of 11,100 before anyone could realise it,” Sameet Chavan, Chief Analyst, Technicals & Derivatives at Angel Broking told Moneycontrol.

“Traders should look to take some money off the table ahead of the major event (Budget). Last year, trading before the budget was quite easy as compared to the current one; but now, low hanging fruit is already gone and hence, it would be a daunting task finding good trade setups,” he said.

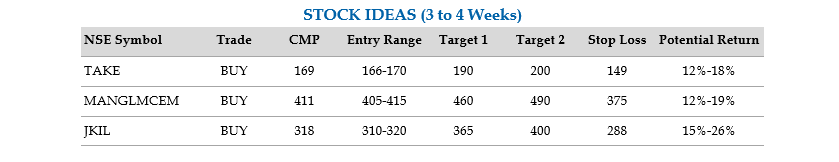

Here is a list of ten trading ideas based on technical parameters to buy ahead of the Budget which could give up to 24 percent return in the short term:

Analyst: Mazhar Mohammad, Chief Strategist – Technical Research & Trading Advisory, Chartviewindia.in

Sun Pharma: BUY| Target Rs650| Stop Loss Rs567| Return 12%

This counter appears to be on the verge of a breakout above its three old downward sloping channel. A sustainable close above 600 can signal the end of its prolonged downtrend which can kick in a medium-term uptrend in this counter.

Hence, in anticipation of such a breakout, traders should go long for the initial targets placed at Rs650 with a stop below Rs567 on closing basis.

Tata Elxsi: BUY| Target Rs1190| Stop Loss Rs1000| Return 9.4%

This counter registered a breakout above its three-month-old ascending channel which should accelerate its upmove further towards its lifetime highs of Rs1200.

Considering the volatile nature of this counter, traders should adopt a two-pronged strategy of buying now and on declines around Rs1030 if available at those levels. A stop for the trade should be placed below Rs1000 on a closing basis for an initial target of Rs1,190.

Reliance Industries: BUY| Target Rs1020| Stop Loss Rs934| Return 6%

This counter appears to be in a multi-week corrective and consolidation phase after hitting a lifetime high of Rs957 in last October.

Hence, a current breakout above this high couple of days back with a gap up is encountered with selling pressure. However, as strong support is placed in the zone of Rs940-934, one should make use of the current weakness and go long as it will sooner than latter registers a sustainable breakout above 960 with a target of 1020. A stop for the trade should be a close below 934.

Disclaimer: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.

Analyst: Sameet Chavan, Chief Analyst, Technicals & Derivatives at Angel Broking

Majesco: BUY| Target Rs702| Stop Loss Rs481| Return 24%

The stock has been maintaining its sturdy structure ever since we witnessed a trend reversal around 400 in the month of September 2017.

Recently, there was a breakout seen from the congestion zone around Rs560 along with significantly higher volumes. This development confirmed a ‘Bullish Flag’ pattern on the weekly chart and thereby projecting much higher levels in months to come.

Thus, we recommend buying this stock for a target of Rs.702. The stop loss should be fixed at Rs. 481.

ITC: BUY| Target Rs304| Stop Loss Rs258| Return 8%

After taking a strong knock during the midst of the July month, this stock slipped into a consolidation mode and has contributed nothing in the gigantic rally our markets experienced meanwhile.

Now, looking at past couple of weeks’ price action, it appears that the stock is out of its ‘Sleep Mode’ and poised for a decent up move.

The strong base building process has already been done around 250 – 260 and unless we don’t see any unfavorable outcome from the budget (excised duty on cigarettes), this stock is likely to do well in coming weeks.

Considering it’s over sensitiveness to this announcement, traders are advised to follow strict stop loss at Rs.258 for any long positions. One can look to buy around Rs.275 for a target of Rs.304.

Analyst: Aditya Agarwal, Head Technical Research, Way2Wealth Brokers Pvt. Ltd

LIC Housing Finance: Buy at CMP 559| Target Rs627| Stop loss Rs535| Timeframe 15 to 21 sessions| Return 12%

Looking at the daily chart, the stock has formed a strong base near 540 – 535 zone and due to recent consolidation stock formed inverse head & shoulder pattern on daily chart.

The daily RSI (14) has signaled a probable range shift. Hence, we recommend traders to buy this stock at current level off Rs565 with a price target of Rs627. A Stop loss should be placed at Rs535 on a daily closing basis.

Motherson Sumi Systems Ltd: Sell around Rs370 – 375| Target Rs340| Stop loss Rs389| Time frame 15 to 21 trading sessions| Return 8%

Looking at the daily chart, the stock has been in a long-protracted uptrend since past several months and in that optimism, the stock hit a fresh all-time high of around Rs396.

Subsequently, stock saw mild profit booking which was followed by consolidation. As a result, the stock is forming a triangle pattern. The daily RSI (14) is struggling to cross 60 levels which doesn’t bode well for bulls.

Also, we are observing three-point bearish divergences on the weekly chart. Hence, we advocate traders to go short in this stock around Rs370-375 with a price target of Rs340 and a stop loss placed above Rs389.

Suven Life Sciences: Buy above Rs223| Target Rs268| Stop loss Rs196| Time frame 15 to 21 trading session| Return 24%

Looking at the weekly chart, the stock has confirmed its breakout from downward sloping trend line during mid-October 2017 which triggered a fresh buying interest.

In that optimism, the stock rallied towards 230. Subsequently, stock witnessed profit booking which led to gradual correction followed by consolidation.

Now, the daily chart has formed a Bullish Cup & handle pattern and the formation of handle formation is in process. The said pattern will be confirmed once stock breaches the Rs223 levels.

In that case, we expect an acceleration of bullish momentum and stock likely to rally towards Rs268. A stop loss should be placed below Rs196.

Analyst: Rajesh Palviya, Head – Technical & Derivatives Analyst, Axis Securities

Adani Ports: CMP Rs436| Target Rs460-470| Stop Loss Rs418| Time 8-15 days| Return 7.8%

The stock has witnessed the breakout of symmetrical triangle pattern breakout on weekly chart at427 level. The stock was consolidating in range of 380-425 range since last three months.

The breakout of the Triangle pattern suggests stock can move towards 460-470 level in the short term. The stock is sustaining above all its important moving averages which support bullish sentiment ahead.

The weekly and the daily strength indicators are in positive territory which indicates the bullish trend to continue in short term.

Vedanta Ltd: CMP Rs345.4| Target Rs370-376| Stop Loss Rs325| Time 8-15 days| Return 9%

The most prominent observation on the price chart of Vedanta is that the entire consolidation underway since November 2017 till date has formed a Cup and Handle formation.

The breakout of this formation is witnessed at 345 levels on the daily chart. The stock is sustaining above its 20, 50, 100 & 200 day SMA which supports bullish sentiments ahead.

On the volumes front, the stock has witnessed a significant rise in breakout level indicating increased participation on the rally.

Both weekly & monthly strength indicator RSI is in bullish territory and sustaining above their reference lines which signals strength and upward momentum in price. Thus, taking into consideration the above factors, the maximum upside can be expected to 370-376.

Disclaimer: The views and investment tips are expressed by the investment experts on moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.