The index formed a Doji type of pattern after a strong bullish candle which suggests that the momentum could take a pause.

The Nifty climbed its crucial resistance level of 10400 on Tuesday but lost momentum towards the close of the session and made a ‘Doji’ type of candlestick pattern on the daily charts.

The index formed a Doji type of pattern after a strong bullish candle which suggests that the momentum could take a pause; hence, for bulls to remain control Nifty should hold above 10,348 levels.

A ‘Doji’ is formed when the index opens and then closes approximately around the same level but remain volatile throughout the day which is indicated by its long shadow on either side. It appears like a cross or a plus sign.

The Nifty index opened at 10412 and rose to an intraday high of 10424. It slipped below 10400 in intraday trade to record its intraday low of 10381 before closing the day at 10,402, up 22 points.

“The Nifty may be in need of a breather as momentum oscillators on short-term charts are in an extremely overbought zone and hence unless it gets past its 50-Day Simple Moving Average, whose value is placed around 10438, which successfully curtailed its up move in the past,” he said.

Mohammad further added that bulls may not pick up momentum going forward and a close below 10348 shall confirm short-term weakness in the indices. Hence, it looks prudent for traders to book profits and remain on sidelines till such a breakout occurs above 10450 on a closing basis.

India VIX fell down up 2.51 percent at 14.49. A decline in VIX suggests a range bound move with limited upside as well downside in the market.

We have collated the top 15 data points to help you spot profitable trades:

Key support and resistance level for Nifty

The Nifty closed at 10,402.2 on Tuesday. According to Pivot charts, the key support level is placed at 10,380.87, followed by 10,359.53. If the index starts moving upwards, key resistance levels to watch out are 10,424.17 and 10,446.13.

Nifty Bank

The Nifty Bank index closed at 25,226.8. The important Pivot level, which will act as crucial support for the index, is placed at 25,138.04, followed by 25,049.27. On the upside, key resistance levels are placed at 25,297.74, followed by 25,368.67.

Call Options data

In terms of open interest, the 10,500 call option has seen the most call writing so far at 41.66 lakh contracts. This could act as a crucial resistance level for the index in the April series.

The second-highest buildup has taken place in the 11,000 Call option, which has seen 38.76 lakh contracts getting written so far. The 10,700 Call option has accumulated 36.25 lakh contracts.

Call writing was seen at the strike price of 10,500, which added 2.03 lakh contracts, followed by 10,600, which added 1.13 lakh contracts, and 10,400, which added 1 lakh contracts.

Call unwinding was seen at the strike price of 10,300, which shed 2.89 lakh contracts.

Put Options data

Maximum open interest in put options was seen at a strike price of 10,000, in which 45.66 lakh contracts been added till date. This could be a crucial resistance level for the index in April series.

The 10,200 put option comes next, having added 39.24 lakh contracts so far, and the 10,300 put option, which has now accumulated 38.76 lakh contracts.

During the session, put writing was seen the most at a strike price of 10,400, with 9.73 lakh contracts being added, followed by 10,300, which added 6.33 lakh contracts and 10,200 with 3.01 lakh contracts.

There was hardly any Put unwinding seen.

FII & DII data:

Foreign institutional investors (FIIs) sold shares worth Rs 684.99 crore, while domestic institutional investors bought shares worth Rs 653.65 crore in the Indian equity market, as per provisional data available on the NSE.

Fund flow picture:

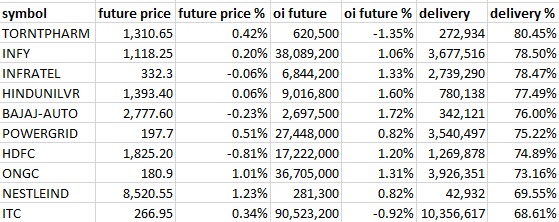

Stocks with high delivery percentage:

High delivery percentage suggests that investors are accepting delivery of the stock, which means that investors are bullish on it.

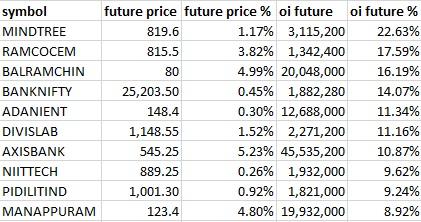

68 stocks saw long buildup

38 stocks saw short covering:

A decrease in open interest along with an increase in price mostly indicates short covering.

57 stocks saw short build-up:

An increase in open interest along with a decrease in price mostly indicates build-up of short positions.

45 stocks saw long unwinding

Bulk Deals:

VRL Logistics Limited: Morgan Stanley Mauritius Company Ltd sold 5,26,393 shares at Rs 389.22 per share

Apl Apollo Tubes Ltd: WF Asian Reconnaissance Fund Limited bought 2,64,000 shares at Rs 2140 per share

Supreme Industries Ltd: Smallcap World Fund INC sold 17,99,545 shares at Rs 1205 per share.

(For more bulk deals click here)

Analyst or Board Meet/Briefings:

Indian Hotels: At a public event, the company met around 17 institutional investors on April 10, 2018.

Mahindra & Mahindra: BOB Capital Markets along with several other funds and investors will meet the company between April 11 and 12, 2018.

Stocks in news:

Tech Mahindra: Balbix tie up with the company for artificial intelligence-based cyber security platform

Dr Reddy’s Labs: Company gets EIR from USFDA for Cuernavaca plant in Mexico

Punjab National Bank: Fitch has Downgraded PNB’s Viability Rating To ‘BB-‘; Maintains Rating Watch Negative

Calix, Infosys Enter Strategic CoCreation Partnership to Accelerate Time to Market for New Capabilities on AXOS Platform

Max Life: Company leads race to buy IDBI Federal Life stake

MRPL: Company trims oil purchase deal with Saudi Aramco: Sources

JSW Steel, AION get creditors’ nod for Monnet Ispat takeover

2 stocks under ban period on NSE

Security in ban period for the next day’s trade under the F&O segment includes companies in which the security has crossed 95 percent of the market-wide position limit.

For April 11, 2018 Jet Airways and Balrampur Chini are present in this list.

December 31, 2024 at 1:14 am

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

February 20, 2025 at 1:16 am

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

February 27, 2025 at 6:39 am

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

March 3, 2025 at 9:09 pm

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

March 8, 2025 at 6:39 pm

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

March 9, 2025 at 10:33 pm

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://accounts.binance.com/en/register?ref=JHQQKNKN

March 21, 2025 at 7:46 pm

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

April 27, 2025 at 11:14 pm

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

May 22, 2025 at 2:52 pm

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

August 26, 2025 at 6:56 am

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

August 29, 2025 at 6:42 am

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://accounts.binance.com/register?ref=P9L9FQKY