Indian market saw profit booking after rising for 5 out of 6 trading sessions ahead of the big event, ‘Budget 2018’. The index formed a Bearish Belt Hold kind of pattern on the daily candlestick charts which suggest caution for traders.

The index formed a Bearish Belt Hold kind of pattern after a small bullish candle which suggests that the momentum is slowing down. Investors should tread with caution in the run-up to the budget and maintain a strict stop loss below 10896.

A ‘Bearish Belt Hold’ pattern is formed when the opening price becomes the highest point of the trading day (intraday high) and the index declines throughout the trading day making up for the large body. The candle will either have a small or no upper shadow and small lower shadow.

In Tuesday’s price action, Nifty50 opened at 11,120.85 and rose marginally to 11,121.10. The bears took control of D-Street in morning trade and pushed the index below its 5-days exponential moving average (DEMA). The Nifty slipped to an intraday low of 11,033 before it closing 80 points lower at 11,049.65.

“The Nifty formed a Bearish Belt Hold candle on the daily chart and closed the session with the loss of around 80 points. It wiped out the gains of last three sessions but still holding above psychological 11,000-mark,” Chandan Taparia, Derivatives, and Technical Analyst at Motilal Oswal Securities told Moneycontrol.

“Now, Nifty has to cross and hold above 11111 zones to extend its move towards 11170 then 11250 levels while on the downside support exists at 10990 then 10888 levels,” he said.

India VIX fell down by 8.24 percent at 16.41. The sudden decline in VIX has hurt the option premium ahead of Union Budget. However, if VIX cools down then it would be a positive sign for the market to hold the lower supports, suggest experts.

We have collated the top fifteen data points to help you spot profitable trade:

Key Support & Resistance Level for Nifty:

The Nifty closed at 11,049.7 on Tuesday. According to Pivot charts, the key support level is placed at 11,015.37, followed by 10,981.03. If the index starts to move higher, key resistance levels to watch out are 11,102.57 and 11,155.43.

Nifty Bank:

The Nifty Bank closed at 27,269.1. Important Pivot level, which will act as crucial support for the index, is placed at 27,184.07, followed by 27,099.03. On the upside, key resistance levels are placed at 27,412.17, followed by 27,555.23.

Call Options Data:

Maximum call open interest (OI) of 29.68 lakh contracts stands at strike price 11,500, which will be a crucial base for the January series, followed by 11,000, which now holds 27.99 lakh contracts in open interest, and 11,200, which has accumulated 24.06 lakh contracts in OI.

Call writing was seen at the strike price of 11,500, which saw the addition of 4.98 lakh contracts along with 11,300, which added 4.62 lakh contracts, along with 11,100, which saw the addition of 3.21 lakh contracts.

Call unwinding was seen at strike price of 10,800, which shed 1.01 lakh contracts, followed by 10,500, which shed 0.65 lakh contracts.

Put Options Data:

Maximum put OI of 54.01 lakh contracts was seen at strike price 10,500, which will act as a crucial base for January series, followed by 11,000, which now holds 37.6 lakh contracts and 10,700 which has now accumulated 34.46 lakh contracts in open interest.

Maximum Put writing was seen at the strike price of 10,700, which saw the addition of 7.09 lakh contracts, followed by 11,000, which added 3.6 lakh contracts and 10,500, which added 2.55 lakh contracts.

Put unwinding seen the most at strike price of 10,800, which shed 2.08 lakh contracts.

FII & DII Data:

Foreign institutional investors (FIIs) sold shares worth Rs 105.56 crore, while domestic institutional investors (DIIs) sold shares worth Rs 281.65 crore in the Indian equity market, as per provisional data available on the NSE.

Fund Flow Picture:

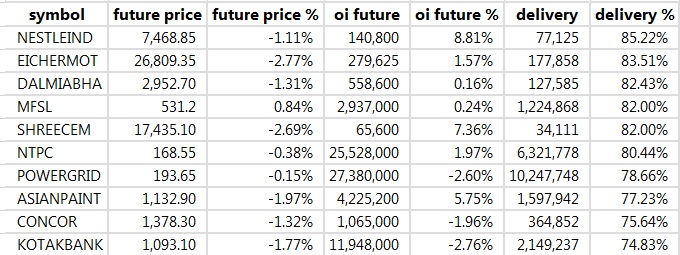

Stocks with high delivery percentage:

High delivery percentage suggests that investors are accepting the delivery of the stock, which means that investors are bullish on the stock.

37 stocks saw long build-up:

28 stocks saw short covering:

A decrease in open interest along with an increase in price mostly indicates short covering.

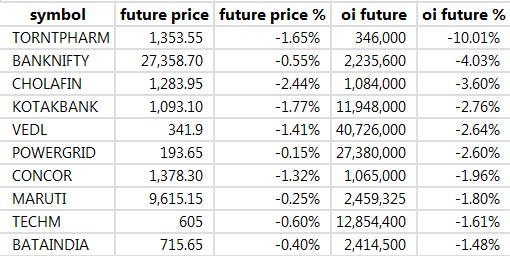

119 stocks saw short build-up:

An increase in open interest along with a decrease in price mostly indicates short positions being built up.

27 stocks saw long unwinding:

Long unwinding happens when there is a decrease in OI as well as in price.

Bulk Deals:

Bhushan Steel: EARC Trust SC 283 sold 1,253,459 shares at Rs 51.51 per share

Himatsingka Seide: Anuradha Himatsingka bought 746,000 shares at Rs 355 per share

KPIT Cummins Infosystems: Alphagrep Commodities Private Limited bought 11,51,890 shares at Rs 215.86 per share

Religare Enterprises: Minesh Jormalbhai Mehta sold 10,00,000 shares at Rs 45.17 per share

(For more bulk deals click here: https://goo.gl/qrXHCH)

Analyst or Board Meet/Briefings:

Aditya Birla Fashion and Retail: The company will be hosting analysts’ call on February 2, 2018.

The management of Arvind Limited will hold a conference call to discuss financial results on January 31, 2018.

Stocks in news:

Mahindra & Mahindra: The company has purchased 26% of the Share Capital of M.I.T.R.A. Agro Equipments Private Limited.

Deepak Nitrite raised around Rs 149 crore from qualified institutional placement.Videocon Industries: To Challenge NCLT Proceedings Against Itself

MCX: SEBI disposes off cases against founders without penalty

InterGlobe: Former Jet Airways CEO Wolfgang Prock-Schauer To Join IndiGo As COO

Idea Cellular: Gets shareholders’ nod for issue of shares via QIP.

2 stocks under ban period on NSE

Security in ban period for the next trade date under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

The security which are banned for trading are JP Associates and Wockhardt.

March 2, 2025 at 9:04 pm

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://www.binance.com/ph/register?ref=B4EPR6J0

May 13, 2025 at 5:13 am

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

June 5, 2025 at 9:00 pm

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

July 1, 2025 at 10:32 am

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?